ARENA STRATEGIC INCOME FUND

ARENA STRATEGIC INCOME FUND (ACSIX)

OBJECTIVE

The Arena Strategic Income Fund (the “Fund”) seeks to generate high income risk adjusted returns with a secondary objective of capital preservation.

COMPETITIVE ADVANTAGES

Intensive Research

Combined with fundamental credit work, we conduct a unique analysis of bond structures, in particular, call features in bonds which may be beneficial to the overall portfolio.

Opportunistic Investing

We seek to increase our investment universe via surveying credit markets for opportunities with similar return profiles (leveraged loans, busted convertible bonds etc.) into the portfolio.

Active Approach

Seeking to increase yield for the same quality or increase quality for the same yield. We take an active approach to managing our portfolios to extract the most value and do not subscribe to “buy and hold” strategies.

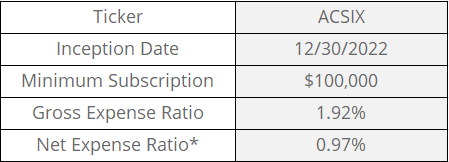

FUND PROFILES

*The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 0.95% of the average daily net assets of the Class I shares of the Fund. This agreement is in effect until February 29, 2036, and it may be terminated before that date only by the Trust’s Board of Trustees.

The Advisor has voluntarily agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that the total annual fund operating expenses do not exceed 0.75% of the average daily net assets of the Fund for the period May 1, 2023 through April 30, 2026. The Advisor may terminate this voluntary reduction at any time.

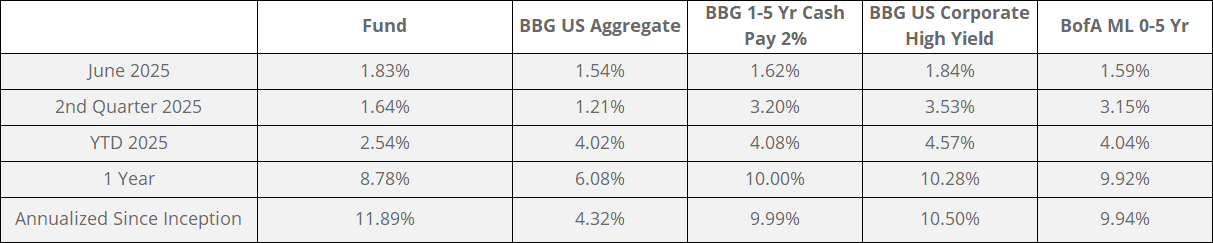

PERFORMANCE AS OF 6/30/25

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance would have been lower without expense limitations in effect. Performance data current to the most recent month end may be obtained by calling 310.806.6700

EFFECTIVE DURATION

MATURITY

TOP 5 HOLDINGS AS OF 6/30/25

Holdings are subject to change at any time and are not a recommendation to buy or sell any security.

TOP 5 SECTORS AS OF 6/30/25

CREDIT QUALITY BREAKDOWN

Definitions

Effective Duration: a duration calculation for bonds that have embedded options. This measure of duration takes into account the fact that expected cash flows will fluctuate as interest rates change and is, therefore, a measure of risk.

Average Maturity: the weighted average of all the current maturities of the debt securities held in the fund.

Bloomberg U.S. High Yield 1-5 Yr Cash Pay 2%: the index includes short-term publicly issued U.S. dollar-denominated high yield corporate bonds.

BofA Merrill Lynch 0-5 Year US High Yield Constrained Index (“HUCD”): an unmanaged index comprised of U.S. dollar denominated below investment grade corporate debt securities publicly issued in the U.S. domestic market with remaining maturities of less than5 years. Allocations to an individual issuer will not exceed 2%.

Bloomberg U.S. Corporate High-Yield Index: measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds.

The Bloomberg US Agg Index: is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).